Crude Oil Futures: Room for further losses near term

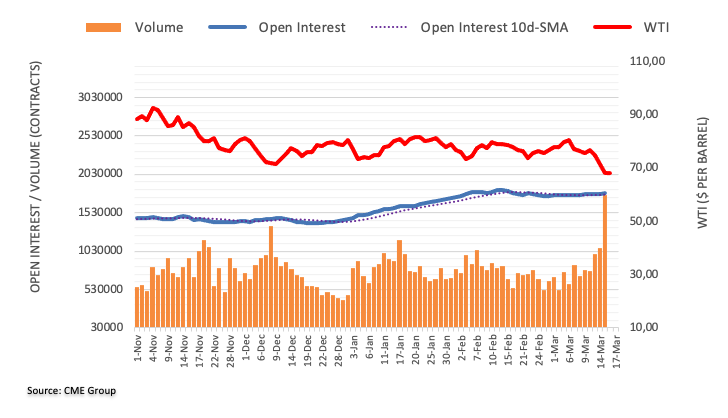

Considering advanced prints from CME Group for crude oil futures markets, open interest resumed the uptrend and went up by around 20.6K contracts on Wednesday, quickly reversing the previous daily drop. Volume followed suit and rose to the highest level since February 24 2022 at 1.752M contracts, up for the third session in a row.

WTI: Next on the downside comes $62.50

Prices of the WTI plummeted below the $66.00 mark per barrel for the first time since December 2021 on Wednesday. The sharp retracement was on the back of increasing open interest and volume and leaves the door open to extra losses in the very near term. A deeper drop should target the December 2021 low at $62.46 (December 2). However, the proximity of the oversold territory carries the potential to spark a near-term bounce.