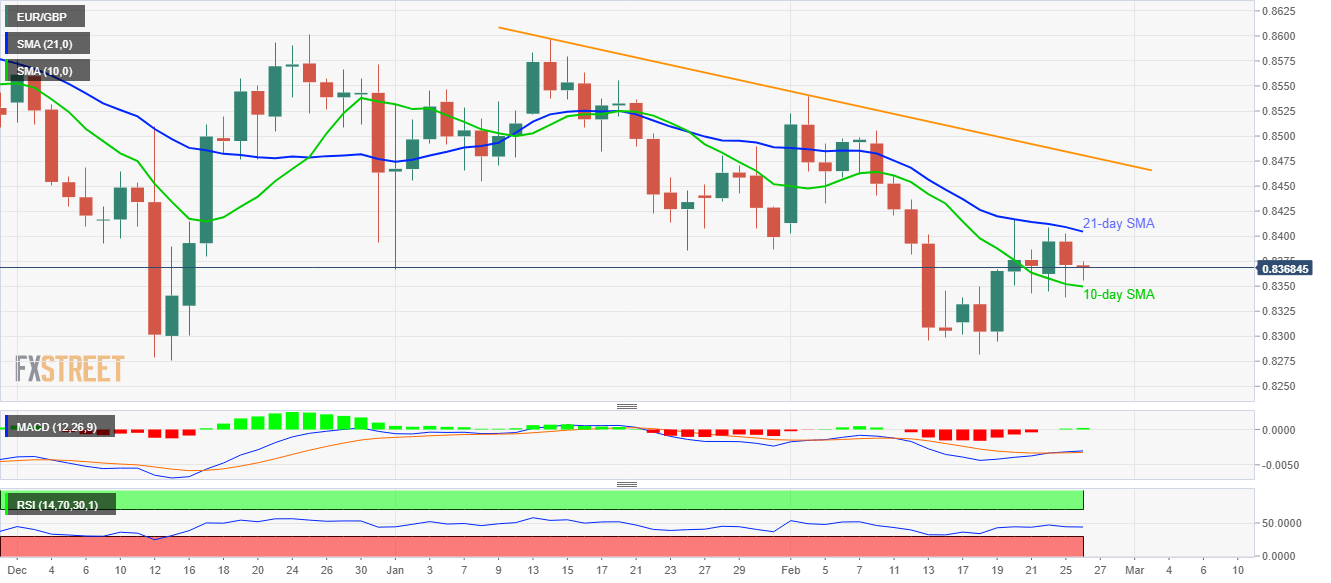

EUR/GBP Price Analysis: Struggles between 10/21-day SMA

- EUR/GBP stays mildly weak while staying between the key short-term SMAs.

- A downward sloping trend line from January 14 adds to the resistance.

- Multiple supports to question the pair’s declines toward 0.8200.

EUR/GBP trades around 0.8370, down 0.02%, while heading into the European session on Wednesday. That said, the pair stays inside a 55-pip range between 21-day and 10-day SMAs.

As a result, traders are less likely to take a fresh entry unless the pair stays within the 0.8405-0.8350 region.

It should be noted that a descending trend line from mid-January can exert additional downside pressure on the quote, around 0.8480, if at all it manages to cross 21-day SMA.

Alternatively, 0.8280/75 area including the lows marked recently as well as in December 2019 could please the bears during the break below 10-day SMA.

Though, pair’s declines below 0.8275 will need to travel through 0.8250 prior to aiming for late-June 2016 low near 0.8200.

EUR/GBP daily chart

Trend: Sideways