EUR/USD surrenders further gains, back near 1.2150

- EUR/USD faltered once again around 1.2180.

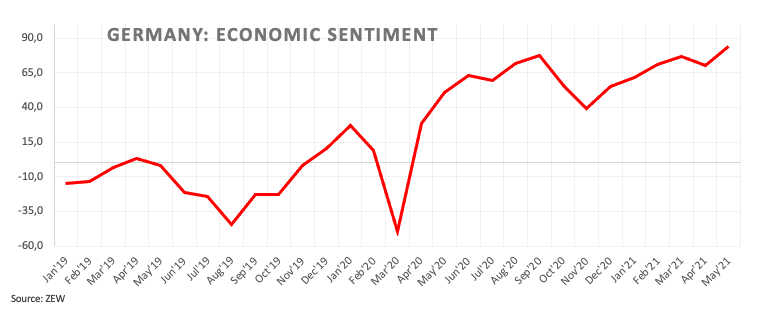

- German, EMU Economic Sentiment surprised to the upside.

- Investors’ attention now shifts to US CPI coming in on Wednesday.

After faltering once again in the upper end of the recent range near 1.2180, EUR/USD triggered a knee-jerk to the 1.2150 region on turnaround Tuesday.

EUR/USD looks to yields, risk trends

EUR/USD manages to reverse Monday’s downtick, although the daily upside has met the “usual” resistance around 1.2180, where coincide monthly tops and a Fibo level (of the November-January rally).

The rebound in US yields plus the current bounce in volatility appears to have prompted the corrective move in the pair, although the daily positive mood remains unchanged so far.

The positive performance in the single currency has been also sustained by the moderate improvement in the Economic Sentiment in both Germany and the broader bloc during May.

Across the pond, the NFIB Index bettered to 99.8 in April and JOLTs Job Openings rose to 8.123 million during March.

What to look for around EUR

EUR/USD extended further the bounce off the 1.1985/80 band and faltered in the 1.2180 region so far, area coincident with a Fibo level (of the November-January rally). The rebound in the sentiment around the single currency stays constructive on the back of the investors’ shift to the improved growth outlook in the Old Continent now that the vaccine campaign appears to have gained some serious pace and solid results from key fundamentals pari passu with the surging morale in the bloc.

Key events in the euro area this week: German, EMU ZEW survey (Tuesday) – EMU Industrial Production, German final April CPI (Wednesday) – ECB Accounts (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections.

EUR/USD levels to watch

So far, spot is gaining 0.34% at 1.2170 and faces the next up barrier at 1.2181 (monthly high May 11) followed by 1.2243 (monthly high Feb.25) and finally 1.2349 (2021 high Jan.6). On the other hand, a breach of 1.1985 (monthly low May 5) would target 1.1947 (200-day SMA) en route to 1.1887 (61.8% Fibo of the November-January rally).